QUESTION:

“We are just starting to look for homes. I’m 100% sure we need to find something FHA approved. What do you think the best approach is, should we find out how much we are approved for first before we begin our search?”

___________________________________________________________

https://GoNHhousing.gov

ANSWER I SENT TO THE INQUIRER:

“There are so many programs out there for first time home-buyers. FHA is great if you don’t have a lot of cash on hand for a down payment. Rural Housing is similar to FHA and they offer additional help with their no money down option…you still need some money for closing costs. Many times asking the seller for funds towards closings costs is a great way to help out too. My post on USDA Rural Housing 2012: http://jennifercote.info/usda-no-money-down-programs/

It is certainly a great idea to talk to a lender first, they will look at your credit to see if there are any red flags. I always say even if you are approved for a higher amount, make sure you will be comfortable with the total monthly cost…mortgage, taxes, utility costs, etc.

If you want to get together to talk, so I can answer any questions, that’s great. My main office is in the Nashua RE/MAX. Of course we could take a look at 1 or 2 properties and chat, walking through a home is a good way to get acquainted.

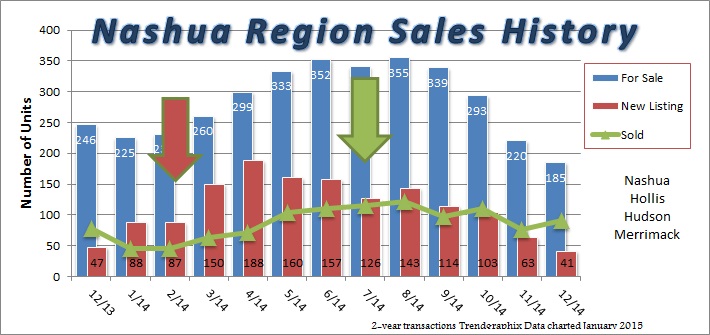

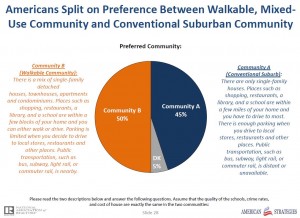

The market under $200,000 is very active right now…multiple offer scenarios going on. You would get approved for more on a house because there is no condo fee…but there’s isn’t a lot of inventory. Any town along a major highway…Merrimack, Nashua, Bedford to even Hudson, Litchfield, tend to be the hot ticket towns. A few clients I just helped looking under $200,000 we started looking in Goffstown, Milford, Wilton and towns west as you can get more for your money typically the more inland and north you go. Manchester is a good option too, but it is the biggest city in NH….the closer you go to the edge of the city the bigger the lots get and more “rural” feeling.

Sorry for the lengthy email. Here’s a link to some towns with properties under $200k, remember, condos you want to go lower because the condo fee is figured into what you are pre-approved for: http://www.nnerenmls.com/nne/maildoc/cot6169_1409497891-”

________________________________________________________

-Just my thoughts- Jenn

**Rural housing uses FHA standards for their appraisals. Blog post from 2009 on FHA requirements: http://jennifercote.info/understanding-fha-appraisals/